When you see a 100x, you drop everything to make that a reality. Big things take time to build, but nothing else is worth building.

How do you explain the feeling you get when you find something new. Something remarkable. Something that goes on to redefine an entire industry. The world. My Portfolio.

How can I explain what it felt like getting my first phone.

What it felt like using crypto for the first time.

Using DeFi. Uniswap. Aave. Yearn. Beefy. FTX. Anchor.

I don’t have to study whitepapers. Learn about the intricacies of Scaling. Blockchain trilemmas. Data Availability. CLOBS vs AMMs. Game Theory. Tokenomics. Interoperability.

To understand innovation.

To understand vibes. Hyperliquid.

The Problem

Finance will move on-chain. Step by step. One sector after another.

First there were the cypherpunks. Ideologists. Today; mainly speculators. A couple fundamental investors. Early funds. Next in line are Institutions. First extractive, then additive as they realize the value-unlocks possible through decentralized rails. Finally. At the end. Businesses and Consumers.

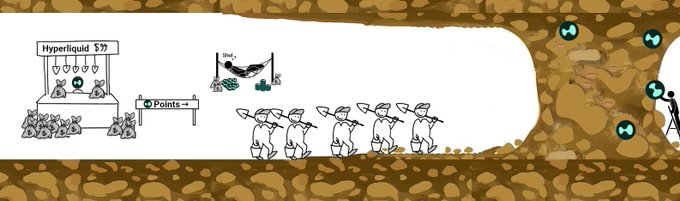

Speculation will remain the #1 use case for a long time. Embrace it if you want to make it. Sure, money will flow into rationality periodically. For beta or for worse. In the end, you want to be left holding dollars. Not Gold. And definitely not Shovels.

Let’s stay with this metaphor for a while. I see the allure behind selling shovels. Not having to head down the trenches mining for gold. Digging through piles of valueless dirt, knee deep in mud and gangue. What many miss however is that the value of the shop selling these shovels, selling infrastructure, is a function of the perceived amount of gold inside the mine.

Pump.fun wouldn’t be profitable if it was on Linea. Sui. Aptos. Cardano.

As a digger, you can simply choose the mine with the greatest amount of perceived gold. As a shovel seller things are a bit more difficult. You have three options.

- You head to a proven mine. One that has produced gold for a while. Has a base of miners that head out daily to farm. One that has a steady demand for shovels. You open up shop. Attempt to outcompete others by offering a subjectively better experience. A better shovel.

- You find yourself next to a depleted mine with barely any gold left. The base of miners is starting to leave. Even trying to compete with you to sell your shitty shovel back to new entrants. What can you do? You hire a couple advisors. They tell you to throw some gold nuggets into the mine. Incentivize farming. Pay for ads. Keep the mine running until you can retire.

- Lastly, you can go out and find a new mine. Be the first one there. Even start mining yourself at the beginning. Put in the work.

Hyperliquid is special in that regard. In part competing with existing Exchanges and in part pioneering a new market.

We already established speculation as the single most powerful strategy in terms of PMF. Exchanges are a natural outgrowth. They facilitate speculation. The ultimate gold mine.

Binance. Coinbase. FTX. The opportunity is clear. Building a leading exchanges requires a lot more than simply copying and improving an existent one however. Sticky elements like trust, liquidity, performance, scope, regulatory clarity, and Tom Brady create a high ceiling of entry.

Unless you start thinking in first principles. Unless you notice that there is a clear issue with present market leaders.

Misalignment. Centralization.

DEX > CEX

I try not to talk in absolutes. This market moves so fast that todays consensus can be tomorrows demise. Remember FTX. Remember Luna, Anchor. I used them all. Doubted them. Sure. Easy to say in hindsight. If nothing happened I’d still be holding. Aware of the risk. Except maybe FTX. Missing that one was largely luck.

I will say this however. The DEX to CEX ratio is destined to hit 80%. We cannot sell TradFi a decentralized system that can’t even efficiently facilitate itself.

So although I never subscribed to the “Not your Keys, not your coins” paranoia, I always kept an open eye for decentralized alternatives to Coinbase and Binance.

GMX, Gains, dYdX, Jupiter, Vertex

I tried every new perp DEX. Used them for a while. Yet. There was always something missing. I couldn’t even put my finger on it nowadays. The experience lacked… excitement.

I used them towards an end. Throwing them out once the job was done. :)

I could go on to dive into the tech here. Say why it makes no sense to go the appchain route. Talk about the issues behind the approaches to attract liquidity. Criticize UX. The lack of AA. Unnecessarily complex incentivization campaigns. Social media strategies. But I don’t believe in that. I believe in vibes. 80/20. Even 90/10.

They were not there.

Enter Hyperliquid. A new experience. Something different. Special. Right from the beginning.

It started how any true love story should starts. I stumbled across it on defillama. Not through some airdrop farming thread or arbitrage strategy. Organically. Looked at it. Deposited. Degen longed BTC.

Today. Almost a year later. After the introduction of points. Of S2. Of spot tokens. The L1. Even after its main narrative arc. I’m still bullish.

Even more so.

Hyperliquid is Dead. Long live Hyperliquid.

I’m not some right curve, math wizard TA genius. I’m just a humble researcher that tries to find some edge in studying yields and early protocols. I hold spot for the most part. BTC. ETH. SOL.

My rule of thumb was always - if I read it on Twitter it’s already to late. Copy that one. Believe me it’s gold.

So when the first KOLs started talking about HL I was suspicious. That was right after HIP-1. Right after the introduction of spot markets. Who would have thought.

PURR started to resurge. Price targets of $1. $10. Other spot coins launched. The airdrop narrative behind PURR led to a steady uptrend. Soon hodlers and spot traders started to notice that the points distribution favored them. Boom.

I started looking elsewhere. With the narrative in full swing there was no alpha here. For me atleast. I’m sure some secret TG group made millions. That was alright. I’d come back a couple months later, claim my $HL and figure out what to do from there. I was okay with that.

Then the Hyperliquid team did something remarkable. Something they don’t get enough credit for. Any really.

They didn’t jump on top of the hype train. They just let it play out.

No.

They actually steered it. To the benefit of the broader ecosystem.

Airdrop. Drop-top. Smokin’ on points in the black box.

Imagine you have a bunch of mid-curve airdrop farmers bidding your newly launched spot market. You throw them some illiquid incentivization and they keep going. You throw that incentivization somewhere else, they pivot.

The Hyperliquid team realized they could bait all these farmers to raise their KPIs. Need more volume? Let’s expend 200k this week to balance-adjusted-volume. Next week, volume increases. Better liquidity? Incentivize MMs, quoting some bps around limit. Launchpad viability? Incentivize trading newly launched protocol tokens…

It’s genius. Another iteration of the airdrop meta. A quick history lesson.

Illiquid points unlocked benefits like allowing to dictate behavior ex ante without actual token expenditure. Seasons were the next evolution to keep mercenary capital in the loop longer and keep inefficient, flawed ideas running for a while.

Points lacked something though. They could never reproduce the original airdrop meta. A meta were farmers did everything that could possibly give them some multiplier. Quests were meant to do just that but they were to easy to game.

Hyperliquid’s weekly retroactive points fixes this. Weekly dopamine to farmers. A new playbook every week. Without the backlash for pivoting, farming users, withholding points etc.

Only thing left to nail now is TGE.

Grand Finale

There is so much more I like. Communication. Partnerships. Listings. Lack of VCs. That little period between S1 and S2. Vaults. HLP. Community. The way the dashboard defaults to 30D so I’m in the green.

I was recently asked by a friend if it was to late to farm it. I said Yes. And I meant that.

This is one of those protocols were farming will make money but staying up-to-date will yield substantially greater rewards.

I called this article “between Binance and Base” and yet I haven’t even touched on the idea of Vertical Integration and siphoning normies. I guess this will be for another post. Maybe a part II.

For now. Just look at this chart. BNB after the introduction of BSC. A successful exchange announcing an L1.

Okay. Enough bull posting for this week.

Market full of fear. Time to make some money.

Cheers.