I’ve found myself contemplating whether or not to lock up tokens numerous times.

Having made both good and bad experiences, I created a simple mental model that increased my hit rate and gains.

The sweet poison of locking tokens - a thread 🧵

•

Pretty much every protocol under the sun has implemented some form of the locking mechanism.

This helps in supporting price action as a share of tokens leaves the market for a long time/forever.

•

The rewards enticing users to lock can take various forms, some of which I’ll list here:

• Profit share: value accrual through protocol revenue

• Voting power: direct token emissions flow and earn bribes

•

• Boosting: earn higher yields on deployed capital

• Staking pool: earn protocol-native emissions (unsustainable on its own)

These are the main ones out of which protocols mix and match a unique reward mechanism.

•

The rewards scale exponentially with the lock duration and the locking can take the form of single-side or LP locking.

Here’s a great thread from @0xWives on the benefits of an 80/20 locking mechanism.

•

Let’s look at what a good reward mechanism using some of the mentioned strategies can look like.

Recently @BalancerLabs launched their take on the veToken model brought to fame by @CurveFinance, here’s what they did:

•

Users can supply $BAL / $ETH in an 80/20 pool, increasing liquidity and lock the LP tokens to receive veBAL.

veBAL holders get boosted yields (up to 2.5x), voting power to direct liquidity mining emissions (possibility for bribes) and revenue share of the protocol.

•

So far so good. But I’m not a dev or DAO member interested in incentivising stakeholders, securing liquidity or increasing TVL and presumably, neither are you...

How can I use these tools to my advantage then?

Just lock your tokens.

Except, it’s not that simple and here’s why:

•

1. Often times the APR/APY promised by a protocol is eroded through price depreciation over the locked period.

Locking is a great tool to either earn additional yield (f.e. stables) with “risk-on” capital but it should never be the sole focus of the investment.

•

It can be attractive to lock a position for 4 years because the payback period is only 100 days.

However, this doesn’t take dilution, revenue fluctuation or other systemic/protocol risks into account.

•

2. The opportunity costs of such a position are also often overlooked. Especially with the crazy high "risk-free" rate, we experience in crypto

•

You lock up $10k, get back $5k over the course of 3 months and then the protocol gets exploited/rugs/narrative shifts etc.

Not only did you lose $5k but on top of that the profit, you could have made if you just farmed stables or bought another coin.

•

3. "Your size is not size"

It makes sense to enter concentrated big bets. But are you comfortable locking up 10% of your portfolio for a year?

What if your position grows 100x and your net worth is perfectly correlated to the protocol's token (tbf that’s a good problem to have)?

•

Going under that percentage means you’re spreading yourself very thin.

Overhead costs increase dramatically with additional positions.

Here’s a great thread by @thedefiedge that touches on portfolio sizing:

•

So are you better of providing liquidity for a token/stable pair? Not necessarily.

There are scenarios where locking can be incredibly profitable. Especially for weak-handed individuals like myself.

•

Locking makes it impossible to sell a position if you have a short-term need for capital or FUD gets to you.

It’s a simple set and forget strategy that forces you to hold until the very end.

•

There’s no hassle in working out TPs or SLs and you’re not forced to monitor the project closely.

Now if the protocol gains traction, you’ve made it.

•

So which projects should you lock and which are better thought of as quick flips?

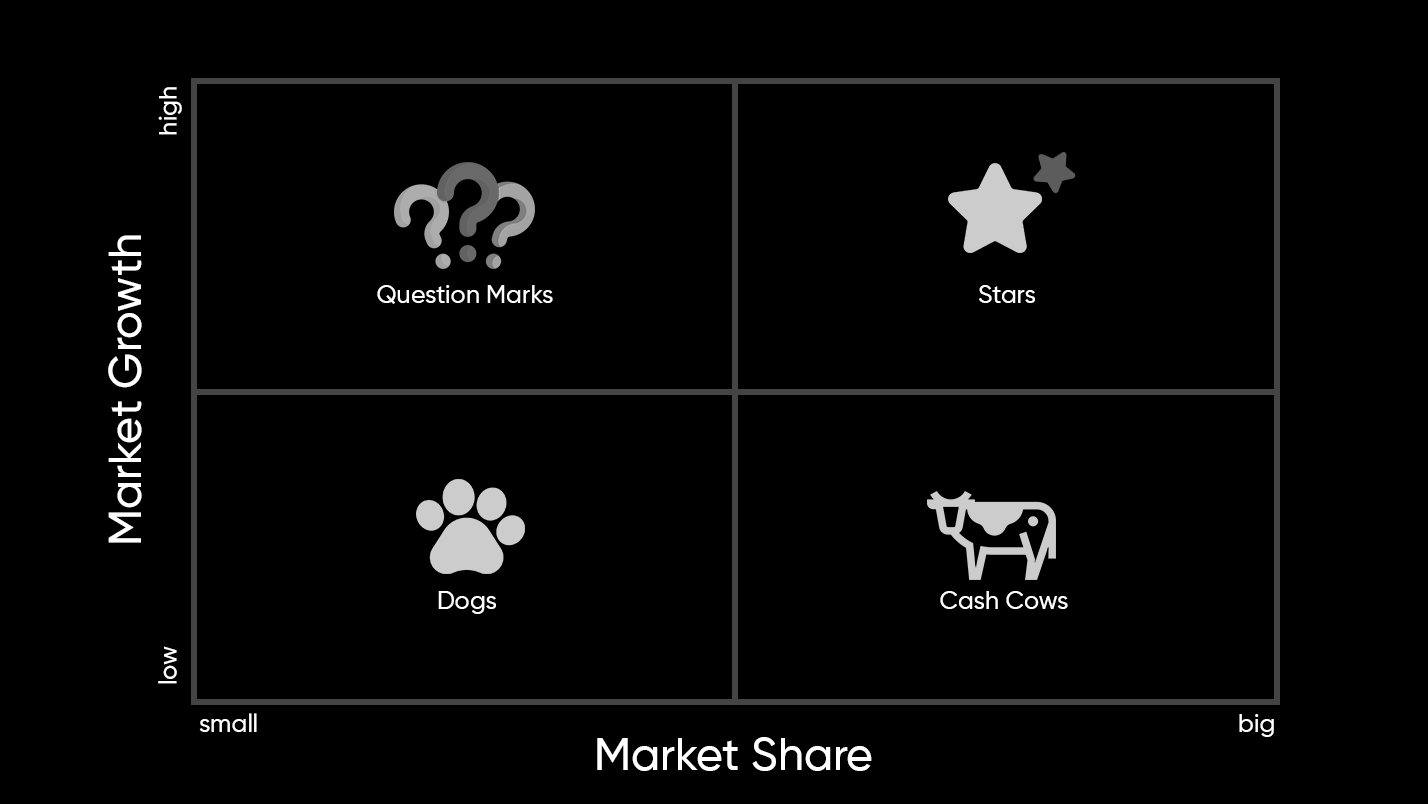

There’s a model you probably have heard of already that illustrates my thought process perfectly.

It’s the BCG growth/share matrix.

•

1. Dogs

Projects that are out of the narrative, have low market share and no growth catalysator in sight.

These don’t have to be unprofitable in the long term but at that point in time, they bring no value to the table.

It makes no sense to lock a project like this.

•

2. Question Marks - $VTX

Projects that are in a rapidly growing market but have yet to capitalize on that.

My favourite type of project as you can find real gems here and earn huge multipliers.

Finding one that checks all boxes and locking it will be incredibly profitable.

•

3. Stars - $CRV

Projects that are already significant players in the crypto landscape.

No-brainer for portfolios with size as they continue to print.

I’d rather be in the trenches looking for QMs but for most people, it makes more sense to lock up these.

•

4. Cash Cows

No lockable project has reached this state yet but it’s bound to happen.

You could probably put $ETH staking in here.

In traditional finance, this sector hosts dividend stocks like Coca Cola with huge market share in already saturated markets.

•

My conclusion:

Locking is a great tool to compound or de-risk high confidence bets but should only be seen as such and not as an opportunity to build “perpetual passive income for generations”.

•

Think of all locking protocols as Ponzi schemes.

Make sure the runway is long enough to guarantee that you’ll be able to jump ship in profit.

A good rule to live by is:

“Never buy a coin only for passive income”.

This also holds true for basically any node project out there.

•

I'll quickly go over 2 personal lessons where locking has/would have made a huge impact.

1. Vector Finance - $VTX

I found Vector through @blocmatesdotcom and used it to gain exposure to $AVAX and the $PTP wars.

•

After buying with 5% of my portfolio I locked the tokens and started earning yield.

This position is now at a rough 4x and I’m confident it’ll grow more.

The yield is also very attractive at around $40 a day as I start to take out my initial.

•

2. Deus Finance - $DEUS

Deus had been on my radar for a long time. I was introduced to the project through a friend even before it had launched.

Sometime in mid-Feb I saw some threads from @hufhaus9 and @rektdiomedes and proceeded to fully research and subsequently buy it.

•

As there was no locking mechanism at the time I just held it in my wallet as it grew.

At a 2x I decided to exit a chunk of my position and missed out on huge gains even though I was super bullish on the project.

Locking would have made me a lot of money here.